Government

Agendas for our public meetings will be posted online at least 2 days before the meeting. The coinciding minutes will be posted after being approved at the following meeting. Use the filter icon or search bar to find the meeting you are looking for. If you are searching for older meeting information, please contact our office to make the request.

Under Section 29 of the MGA, the CAO is responsible to the Council for the proper administration of the affairs of the Municipality in accordance with the By-Laws of the Municipality and the policies adopted by the Council.

- Requests must be made in writing (mail or email) to the Deputy Municipal Clerk’s Office.

Deputy Municipal Clerk

Municipality of the District of Yarmouth

932 Highway 1

Hebron, NS B5A 5Z5

Email Jenny Porter - Applicant must indicate who they would like to present to; Council or a specific Committee of Council.

- Must provide a written summary of their presentation topic and points.

- Only the person booked to make a presentation may speak at the meeting.

- Presentations will only be received on matters directly related to Municipal Government and the mandate of Council’s standing committees.

- The presenter(s) will be contacted by the Administration team regarding the date and time of their presentation to Council.

- Presentations can be up to a maximum of 10 minutes, followed by 10 minutes allotted for Q&A.

For any questions concerning presenting to Council or a Committee of Council, please contact Jenny Porter, Deputy Municipal Clerk at 902-742-7159.

Official notices regarding by-laws are published on this page. Notices of Approvals are listed first. Scroll down to see Notices of Second Readings and Notices of Adoption.

Notices of Approvals

Vending By-Law V-1048-25

Water Upgrade Lending Program By-Law W-1028-25

These By-Laws are made under the Provisions of the Municipal Government Act.

Chief Administrative Officer

This notice was posted on this site on September 2nd, 2025

PLEASE TAKE NOTICE THAT the Municipality of the District of Yarmouth Council adopted the amendments to the Municipal Planning Strategy and Land Use By-law on January 22, 2025. These adopted amendments address short-term rentals in a manner substantially similar to what is outlined in Appendix A of the Public Participation Meeting report dated October 24, 2024.

The documents have been reviewed and approved by the Department of Municipal Affairs as per Section 208 of the Municipal Government Act these amendments become effective as of the date of this notice.

The documents can be viewed online at https://munyarmouth.ca/ or copies can be obtained from the Municipal Administration Building located 932 Highway 1, Hebron between 8:00 am to 5:00 pm Monday through Friday (closed Holidays; photo copying fees apply).

Victoria Brooks

Chief Administrative Officer

This notice was posted on this site on June 26, 2025.

PLEASE TAKE NOTICE THAT at its Regular Council meeting on May 21, 2025, Council approved second and final reading of the amendments to Sewer By-Law S-084-25. This By-Law is made under the Provisions of the Municipal Government Act and is intended to encompass all municipal sewer system areas.

The document is available https://munyarmouth.ca/government/by-laws, or copies can be obtained or viewed at the Administration Building located at 932 Highway 1, Hebron, between the hours of 8:00 a.m. and 5:00 p.m., Monday through Friday (excluding holidays; copy fees apply).

Victoria Brooks

Chief Administrative Officer

This notice was posted to this site on June 12, 2025

PLEASE TAKE NOTICE THAT at its Regular Council meeting on January 22, 2025, Council approved second and final reading of the amendments to Land Use By-Law.

The purpose of these amendments is to allow accessory dwellings in the front yard of a lot by removing Land Use By-law subsection7.1 (d) “ii. the accessory dwelling shall be located in the rear or side yard”.

In accordance to Section 169 of the Municipal Government Act these amendments become effective as the date of this notice.

Victoria Brooks

Chief Administration Officer

This notice was posted to this site on March 7, 2025

PLEASE TAKE NOTICE THAT at its regular Council meeting on December 18, 2024, Council approved second and final reading of the amendments to Tax Exemption By-Law T-082-24.

The purpose of this By-Law is to provide a reduction of taxes to nonprofit community, charitable, fraternal, educational, recreation, religious, cultural or sporting organization if, in the opinion of Council, the organization provides a service that might otherwise be a responsibility of the council as allowed under Section 71(1) of the Municipal Government Act.

The document can be viewed by interested persons between the hours of 8:30 am and 4:30 pm, Monday through Friday (excluding Holidays; copy fees apply) at the Municipal Administration Building, located at 932 Highway 1, Hebron, or on our website by visiting https://munyarmouth.ca/government/by-laws.

Victoria Brooks

Chief Administration Officer

This notice was posted to this site on January 7, 2025

TAKE NOTICE THAT the Municipality of the District of Yarmouth Council adopted the amendments to the Commercial Development District (CDD) Improvement By-law C-038-19 on August 7, 2024.

The documents have been reviewed by the Department of Municipal Affairs as per Section 208 of the Municipal Government Act. In accordance to Section 169 of the Municipal Government Act, these amendments become effective as the date of this notice.

The documents can be viewed online at https://munyarmouth.ca/government/by-laws or copies obtained from the Municipal Administration Building located 932 Highway 1, Hebron, between 8:00 am to 5:00 pm, Monday through Friday (closed Holidays; copy fees apply).

Victoria Brooks

Chief Administrative Officer

This notice was posted to this site on December 11, 2024.

Notices of Second Readings

Notices of Second Reading

PLEASE TAKE NOTICE THAT at its regular Council meeting on July 16, 2025, Council approved first reading of Vending By-Law V-1048-25. This By-law is made under the provisions of the Municipal Government Act.

Council proposes to repeal and replace Transient Vendor By-law T-088-23 and consider adopting Vending By-Law V-1048-25.

A second reading for the By-Law will occur at the Regular Council meeting, scheduled for Wednesday, August 20, 2025, at 6:00 pm.

The document is available online at https://munyarmouth.ca/government/by-law-notices or copies can be viewed at the Administration Building located 932 Highway 1, Hebron, between the hours of 8:00 a.m. to 5:00 p.m., Monday through Friday (excluding Holidays; printing fees applied).

Victoria Brooks

Chief Administrative Officer

This notice was posted on this website on July 28, 2025.

Notices of Second Reading

PLEASE TAKE NOTICE THAT at its regular Council meeting on July 16, 2025, Council approved first reading of Water Supply Upgrade Lending Program By-Law W-1028-25.

Council proposes to repeal and replace Water Supply Lending Program By-Law W-1028-17 and consider adopting Water Supply Upgrade Lending Program By-Law W-1028-25.

A second reading for the By-Law will occur at the Regular Council meeting, scheduled for Wednesday, August 20, 2025, at 6:00 pm.

The document is available online at https://munyarmouth.ca/government/by-law-notices or copies can be viewed at the Administration Building located 932 Highway 1, Hebron, between the hours of 8:00 a.m. to 5:00 p.m., Monday through Friday (excluding Holidays; printing fees applied).

Victoria Brooks

Chief Administrative Officer

This notice was posted on this website on July 28, 2025

Notices of Second Reading

PLEASE TAKE NOTICE THAT at its regular Council meeting on April 23, 2025, the Council approved the first reading of Sewer By-Law S-084-25.

The Council proposes to repeal and replace Sewer By-law S-084-24. The second reading for Sewer By-Law S-084-25 will occur at the Regular Council meeting scheduled for Wednesday, May 21, 2025, at 6:00 p.m., at the Administration Building, located 932 Highway 1, Hebron, NS.

The document is available online at HERE or copies can be obtained or viewed at the Administration Building located at 932 Highway 1, Hebron, between the hours of 8:00 a.m. and 5:00 p.m., Monday through Friday (excluding holidays; copy fees apply).

Victoria Brooks

Chief Administrative Officer

This notice was posted to this site on May 2, 2025

Notices of Second Reading

Please take notice that at its regular Council meeting on September 18, 2024, Council approved first reading of Tax Exemption By-Law T-082-24.

Council proposes to repeal and replace Tax Exemption By-Law T-082-03 and second reading for Tax Exemption By-Law T-082-24 will occur at the Regular Council meeting, scheduled for Wednesday, December 18, 2024, 6:00 p.m. at the Administration Building, located at 932 Highway 1, Hebron, NS.

The document is available here or copies can be viewed at the Administration Building located 932 Highway 1, Hebron, between the hours of 8:00 a.m. to 5:00 p.m., Monday through Friday (excluding Holidays, copy fees apply).

Victoria Brooks

Chief Administrative Officer

This notice was posted to this site on November 26, 2024.

Notices of Adoption

Notices of Adoption

Land Use By-law Amendement

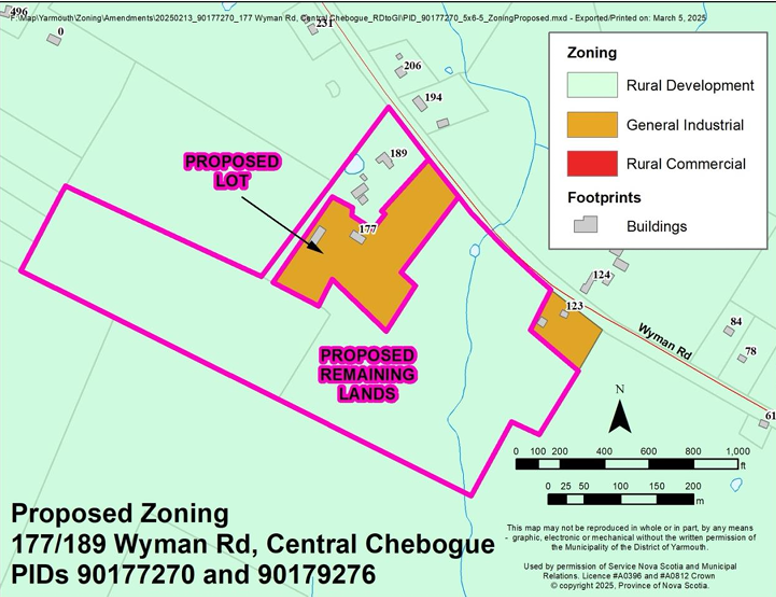

This is to advise that Council, at its regular meeting held April 23, 2025, in the Council Chambers of the Municipal Administration Building, civic #932 Highway 1, Hebron, approved second reading and adoption of the Land Use By-Law amendment to Zoning Map Schedule B of the Land Use By-law to rezone a portion of PID 90177270 and PID 90179276, located 177 Wyman Road from Rural Development (RD) to General Industrial (GI) in order to subdivide the lot and for the purpose to separate the existing home-based business from the single-family home on the same property. A sketch of the subject property is shown below.

Any aggrieved person, the Provincial Director of Planning, or the Council of any adjoining municipality may, within fourteen (14) days of the publishing of this notice, appeal to the Nova Scotia Utility and Review Board in accordance with the provision of the Municipal Government Act.

This notice was posted to this site on May 12, 2025.

Notices of Adoption

Land Use By-law Amendement

This is to advise that Council, at its regular meeting held April 23, 2025, in the Council Chambers of the Municipal Administration Building, civic #932 Highway 1, Hebron, approved second reading and adoption of the Land Use By-Law amendment to ensure that RV parks are developed in a way that aligns with community standards and to minimize negative impacts, it is recommended that Council amend the current Land Use By-Law (LUB) to include site plan approval criteria specifically for RV sites and RV parks in zones where the use is permitted.

Any aggrieved person, the Provincial Director of Planning, or the Council of any adjoining municipality may, within fourteen (14) days of the publishing of this notice, appeal to the Nova Scotia Utility and Review Board in accordance with the provision of the Municipal Government Act.

This notice was posted to this site on May 12, 2025

By carrying out a conversion process during the summer of 2016 of approximately 1,700 of the High-Pressure Sodium (HPS) streetlights throughout our Municipality and taking ownership, (they were formerly owned by NSPI), to new Light Emitting Diode (LED) technology, we have reduced our Streetlight Energy Costs by approximately $240,000.00 per year.

Energy savings are just as impressive with a reduction in kWh output in the range of 50-65%. Put another way, we have reduced our theoretical annual greenhouse gas (GHG) emissions by approximately 200 metric tonnes per year; which in turn is equivalent, theoretically, to the electricity used by 29 homes in a year or the consumption of 448 barrels of oil.

This annual savings is significant to a Municipality of our size and help our Council achieve priorities and operational objectives. On top of that, from an operational point of view, this new technology has delivered better performance in light quality, broadcast area, maintenance requirements and contributions to GHG emissions reductions.

The Municipality of Yarmouth has a pdf Street Lighting Policy whose purpose is to guide staff, council and the general public in the installation, removal and general administration of municipally owned streetlights within the geographical jurisdiction of the Municipality of the District of Yarmouth. Included in the policy is the procedure to follow when requesting a streetlight installation or removal.

Request for Streetlight Installation or Removal

Also included in the Municipality of Yarmouth pdf Street Lighting Policy is the application to pdf Request Streetlight Installation or Removal. This form should be completed and returned to the Public Works Department in the lower level of the municipal building by hand or by post.

Streetlight Outages

Streetlight outages should be reported to the Public Works Department at 902-742-7353. You will be asked to provide the closest civic number to the outage as well as the ID sticker number located on the bottom of the light. This number usually begins with the letters YC.

Taxation FAQ

For tax inquiries:

Email Linda Power

Call: 902-742-7159

There are 3 options for tax payments:

- Pay in person at the Municipal Office in Hebron.

- Mail in your payment: 932 Highway #1, Hebron, NS B5A 5Z5.

- Pay your tax bill through online banking or at your bank.

- Pay by Credit Card through Paymentus Corporation at 1-855-288-4087 (Paymentus is an independent third party company providing a service. Paymentus will charge a fee to your credit card for this service.)

What is the tax, sewer, and fire rates?

Click here to view the tax rate, sewer rate, and fire rate.

How are my tax bills calculated?

The tax calculation is based on the assessed value of the property multiplied by the applicable tax rate divided by 100. The assessed value is the market value or CAP value of the property determined by Property Valuation Services Corporation.

When are my taxes due?

The total amount billed must be paid by the due date, June 30th, to avoid interest charges. Interest is applied at the rate of 1.5% per month to any outstanding balance.

What are the methods of payment?

Payment can be made by cash, cheque, debit, online and telephone banking, or automatic withdrawal.

Can I appeal my tax bill?

No, you cannot appeal your tax bill. Your tax bill is based on your property assessment which is completed by Property Valuation Services Corporation. Your assessment will be mailed to you in January and it is at this time that you have the right to appeal.

How do I change my mailing address?

To change your mailing address, please fill out the pdf Request for Address Change form and return it to our office.

Who do I talk to about my assessment?

If you have questions about your assessment, please contact Property Valuation Services Corporation at 1-800-380-7775 or Property Valuation Services Corporation.